At Mahindra Finance, we always take a personal approach to lending, ensuring that our loans provide you with the funds you need, when you need them. We provide reliable personal loan with attractive interest rates to help you manage your expenses. Our flexible EMI options on personal loans empower you to reach your financial goals without sacrificing your cash flow.

Our instant personal loans are available exclusively for customers and Mahindra Group employees. Whether you’re planning a dream wedding, consolidating debts, or renovating your home, our low-interest loans can help you fulfil your dreams as you’re assured of a first-rate experience, from application to approval. Get a loan that fits your life, not the other way around!

Borrowing options start from INR 50,000 up to 15 Lakhs

You get the option to pay interest only for 12-24 months

Choose your tenure from 24-60 months, with no pre-payment penalty

With minimal documentation you can get the funds you require within few days

Calculating your EMI has never been easier. Use our user-friendly Personal Loan EMI calculator to make informed decisions about your personal loan. Simply enter your desired loan amount, interest rate, and repayment term to instantly view a breakdown of your monthly payments. You can also simply adjust the amount and tenure to see how it affects your EMI repayments.

Our personal loan interest calculator goes beyond basic EMIs, providing a transparent view of the total loan cost with a breakdown of principal and interest, empowering you to compare options and choose the perfect loan for your financial goals. Make faster decisions with our Personal Loan EMI Calculator.

Select Your Loan Type

₹

₹

₹

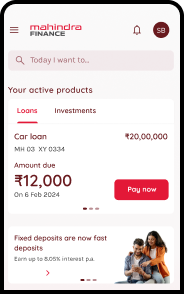

Our Personal Loan application process is easy and gives you an instant turnaround. You can apply for personal loan online or offline which means you can either visit your nearest branch or opt for our quick 4-step online process.

Click on the ‘Apply now’ button and choose the loan type

Complete and verify your KYC and personal details.

Set up the auto-debit mandate via debit card or net-banking

e-Sign the agreement and the money shall be disbursed in your bank account.

Mahindra Finance personal loans are available to existing customers with good repayment history and Mahindra Group employees, aged 21-58 that are not in probation and are active in system.

While specific requirements can vary between lenders, some essential criteria for personal loan are:

Personal loan documents for matured base: Aadhar Number, PAN, CKYC, Aadhar linked mobile number, Bank account number with E-Nach facility

Address Proof-Telephone Bill, Gas Bill, Bank Statement

Other Documents- Salary Slip (3 Months), Bank statement in PDF format (Last 3 months), Cancelled cheque (signature should be the same as signature on PAN Card), Passport size photograph

Disclaimer: MMFSL reserves the right to approve/disapprove the loan after the submission of documents.

At Mahindra Finance, we understand that everyone's financial situation is unique. That's why we offer a variety of personal loan options with interest rates that cater to different profiles and loan needs. We're committed to providing fair and transparent pricing, so you can find the perfect loan to fit your budget.

Attractive Interest Rates based on your eligibility*

Interest RatesCharged based on your product-specific, document, and stamp fees based on the prevailing rates set by the statutory authority and the location of the contract execution. Read more

Processing FeesGet all the answers to your Personal Loans FAQs with Mahindra Finance

Few hours for our digital loans for customers, and within a day for our employees.

Yes.

You can get your pre-approved personal loan from here for our mature customers. Our current customers can reach out to the nearest branch or click here

The loan amount will be based on the eligibility of the applicant.

36 months for our mature customers, and 18 months for the current customers.

The personal loan can be repaid by E-Nach mandate.

The amount shall be disbursed into the bank account where ECS is set up.

Yes, you can prepay your personal loan at a nominal pre-closure rate.

A personal loan offers a versatile solution for a wide range of expenses, from major purchases like appliances or home renovations to unexpected needs like medical bills or car repairs. It can even help you consolidate debt, invest in your business, or make a down payment on a new home.

While the maximum personal loan amount varies, lenders typically consider two key factors: your income and existing debts.

To ensure comfortable repayments, they often won't approve loans where the monthly payment (EMI) exceeds 30% of your salary, especially for salaried employees. Additionally, they factor in your existing EMIs from other loans to assess your overall debt burden and ability to repay the new personal loan.

Ditch the long queues and paperwork! Applying for a personal loan online allows you to conveniently submit your application from the comfort of your own home, saving you valuable time and effort.