India is full of stories, and every tale invokes a sense of inspiration and pride in us. Let’s discover such impressive and phenomenal stories brought to life with candid accounts of our customers. These are real stories fuelled by passion, motivation, and emotion.

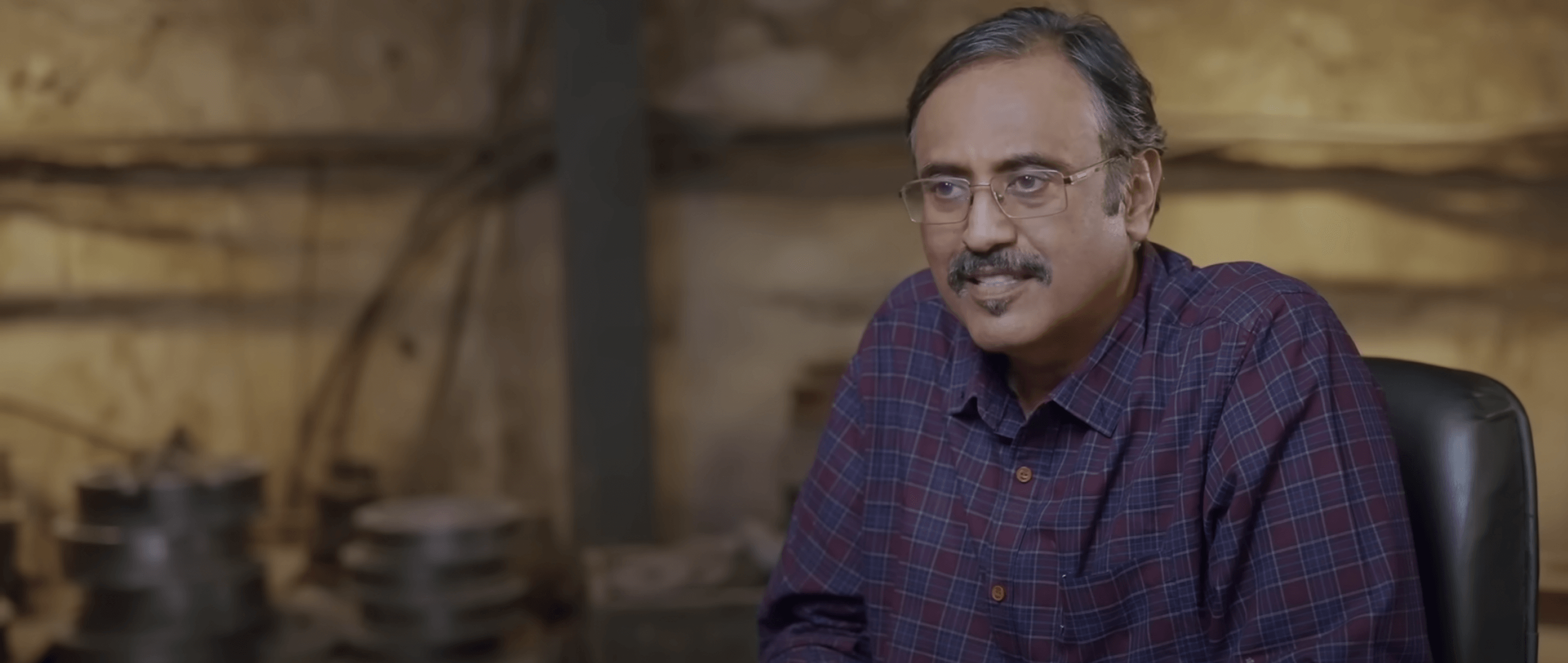

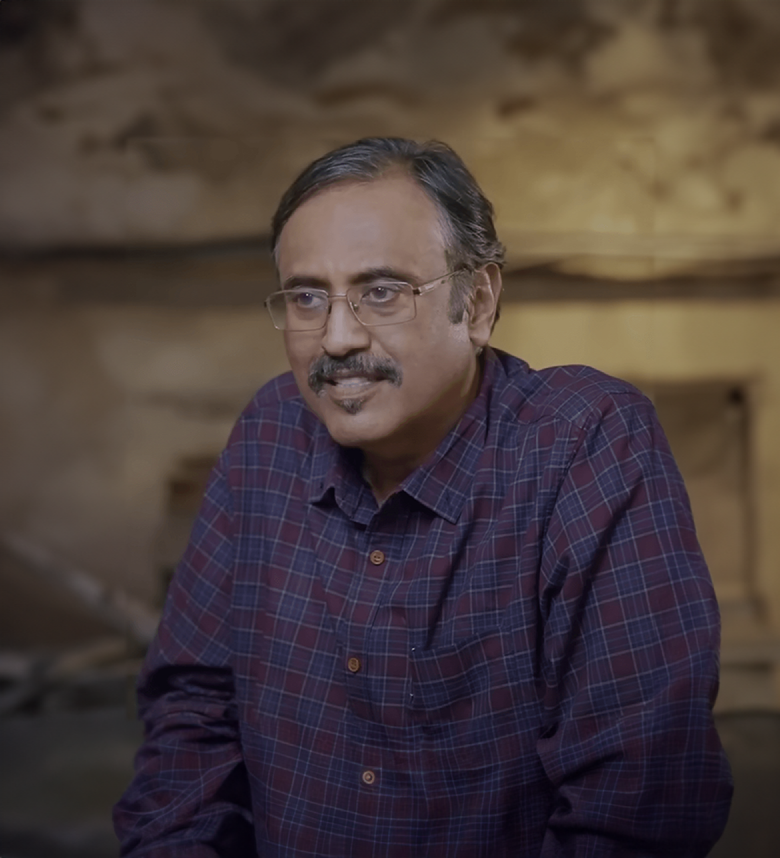

Sanjay Khanna shares how Mahindra Finance’s trust and timely equipment loan helped him increase his business turnover by 35%.

READ MORE

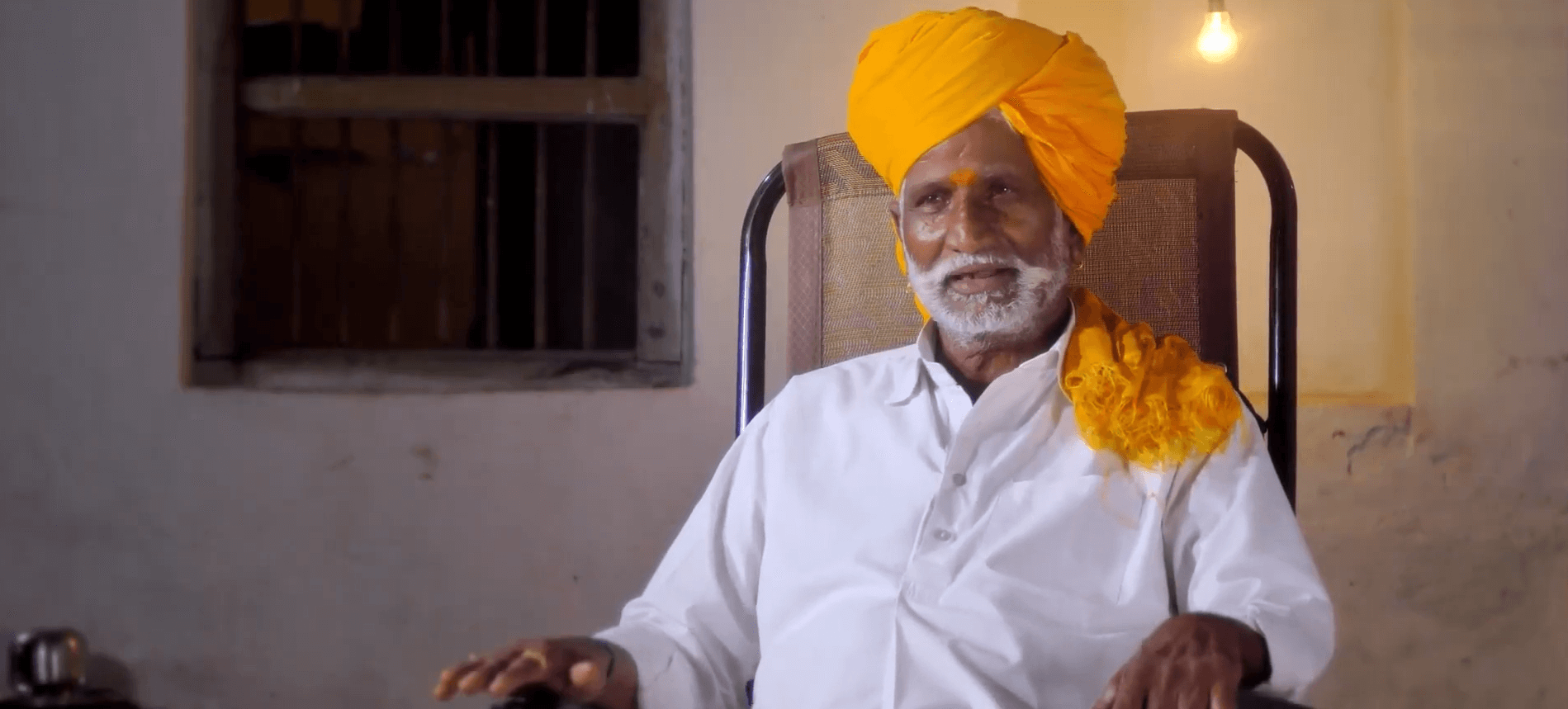

Sangappa Nilappa’s dream to grow together revolutionized the face of his entire village

READ MORE

Ambadas Manda Recalls His Journey To Emerge From The Financial

READ MORE

Shambhusharan Yadav Shares Insights On The Humble Beginnings Of His Business

READ MORE

Datta Mali Talks About How His Sheer Commitment Took Him To The Peaks Of Success

READ MORE

Mr. Sujit Majumdar from Cooch Behar, West Bengal: Rising from financial hardships to owning multiple tractors

READ MORE

Anuradha’s inspiring journey of Go Pink cabs: Empowering women as change makers

READ MORE

Your form has been submitted successfully.