As a leading Non-Banking Financial Company (NBFC), we provide financial solutions that match your needs and help you build a better future. Our services are trusted by over 10 million customers.

Select your Loan amount, interest rate and tenure to calculate your monthly EMI’s with our Loan Calculator. Calculate your Fixed Deposit returns by selecting your investment amount and time horizon.

Select Your Loan Type

₹

₹

₹

Recognized as one of the best Non-Banking Financial Institutions in India, we have been committed to being a positive change agent catering to the financial needs of millions in rural and semi-urban India for the past 32 years.

Customers Served

Villages Covered

Towns Covered

Branches in India

Years Rich Legacy

Stay informed and up-to-date with expert opinions and the latest trends in the world of finance through our informative and engaging blog posts.

Knowledge is power. All your top queries on financing answered right here.

We provide Tractor Loans, Utility Vehicle Loans, Car Loans, Commercial Vehicle Loans, Pre Owned Car Loans, Three Wheeler Loans, Loans Against Vehicle, Home Loans, Personal Loans, Loan Against Property, Machinery Loan and SME Business Loans.

You can drop your contact number in this form and a Mahindra representative will contact you within 48 hours.

Convenience: We have minimal documentation in our loan processes. Reach: We have a strong network of branches in rural and semi-urban India Speed: We focus speed and efficiency with many loan approvals taking only up to 2 working days.

We have very lucrative Fixed Deposits and Mutual Fund investment products available to help you grow your money.

We offer 2 schemes – Samruddhi & Dhanvruddhi.

Mahindra Finance has 1365 branches in India, located across all states of the country.

Yes, for some of our loan products we do offer doorstep service for guidance and documentation.

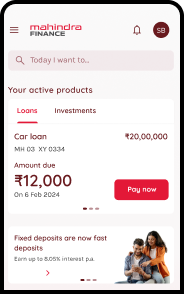

Yes, we have an app available on Google Play Store and Apple Store. Customers can track and manage their EMIs and investments on the app directly.