If you've been eyeing the Maruti Grand Vitara and dreaming of owning this stylish SUV, you're not alone. With its impressive Grand Vitara NCAP rating, spacious interiors, hybrid powertrain, and impressive features, the Grand Vitara average has become one of the most desired midsize SUVs in India. However, before you can drive off into the sunset in your new Suzuki Grand Vitara, you'll need to navigate the process of getting a car loan.

In this comprehensive guide, we'll walk you through each step of applying for a Grand Vitara loan. From understanding the car loan procedure to comparing interest rates and using an EMI calculator, we'll equip you with all the information you need to make an informed decision.

Step 1: Research And Compare Car Loan Options

Before diving into the car loan application process, it's important to do your homework. Start by researching different lenders that offer car loans for the Suzuki Grand Vitara. Look out for key factors such as interest rates, repayment tenure options, processing fees, and customer reviews.

Several lenders, including NBFCs, offer competitive interest rates and flexible repayment options that cater specifically to rural and semi-urban customers. Their easy online application process makes it convenient for individuals living outside major cities to access financial services.

Once you've shortlisted a few lenders, compare their interest rates using online comparison tools or by directly contacting them. Remember that even a slight difference in interest rates can have a significant impact on your EMIs and the overall cost of the loan.

Step 2: Calculate Your Car Loan EMI

Now that you have an idea of the interest rates offered by different lenders, it's time to calculate your Equated Monthly Instalments (EMIs). A car loan EMI calculator is a handy tool that helps you understand how much you'll need to repay each month.

Let's assume you're looking to finance ₹10 lakhs for a Suzuki Grand Vitara at an interest rate of 8.5% for a tenure of 5 years. To calculate your EMI, plug in these details into an online car loan EMI calculator. In this case, your monthly instalment would be approximately ₹20,436.

Remember that your EMI consists of both principal repayment and interest payments. As you progress through the tenure of your loan, the proportion of interest decreases while the principal repayment increases. This means that over time, a larger portion of your EMI goes towards reducing the outstanding Grand Vitara loan amount.

Additional read: Types Of Vehicle Loans In India

Step 3: Gather Required Documents

Once you've decided on a lender and calculated your EMIs, it's time to gather the necessary documents for your car loan application. While specific requirements may vary slightly across lenders, here are some common documents you'll typically need:

- Identity proof: This could be your Aadhaar card, PAN card, or passport.

- Address proof: Utility bills (electricity bill, water bill) or rental agreement.

- Income proof: Salary slips for salaried individuals or income tax returns for self-employed individuals.

- Bank statements: Typically covering the last 6 months.

Step 4: Submit Your Application And Await Approval

With all your documents in order, it's time to submit your car loan application. You can either visit your lender or opt for the quick and convenient online application process.

If you choose to apply online, you'll need to fill in your contact details and await a call back from a loan executive. They will guide you through the document verification process and ensure that all necessary checks are carried out. Once your application is approved, you'll receive confirmation and instructions for successful disbursal.Congratulations! You're now one step closer to owning your dream Suzuki Grand Vitara!

Conclusion

Applying for a Grand Vitara loan doesn't have to be daunting. By following these four simple steps, you can navigate the car loan procedure with ease and make an informed decision about financing your Maruti Grand Vitara.

Remember to research and compare car loan options, calculate your EMIs using an online car loan EMI calculator, gather all required documents, and submit your application either in person or online. Mahindra Finance offers competitive interest rates and a seamless application process, making them a potential solution for your car loan needs.

So go ahead, take that test drive, and get ready to hit the road in your brand new Maruti Grand Vitara average!

FAQs

1) What is the average car loan interest rate?

The average car loan interest rate typically ranges from 8% to 12%, depending on various factors such as the lender, car loan amount, tenure, and individual credit profile.

2) Can I prepay my Grand Vitara loan before the end of the tenure?

Yes, most lenders allow borrowers to prepay their car loans partly or fully before the end of the tenure. However, some lenders may charge a prepayment penalty or fee. It's advisable to check with your chosen lender regarding their prepayment policies.

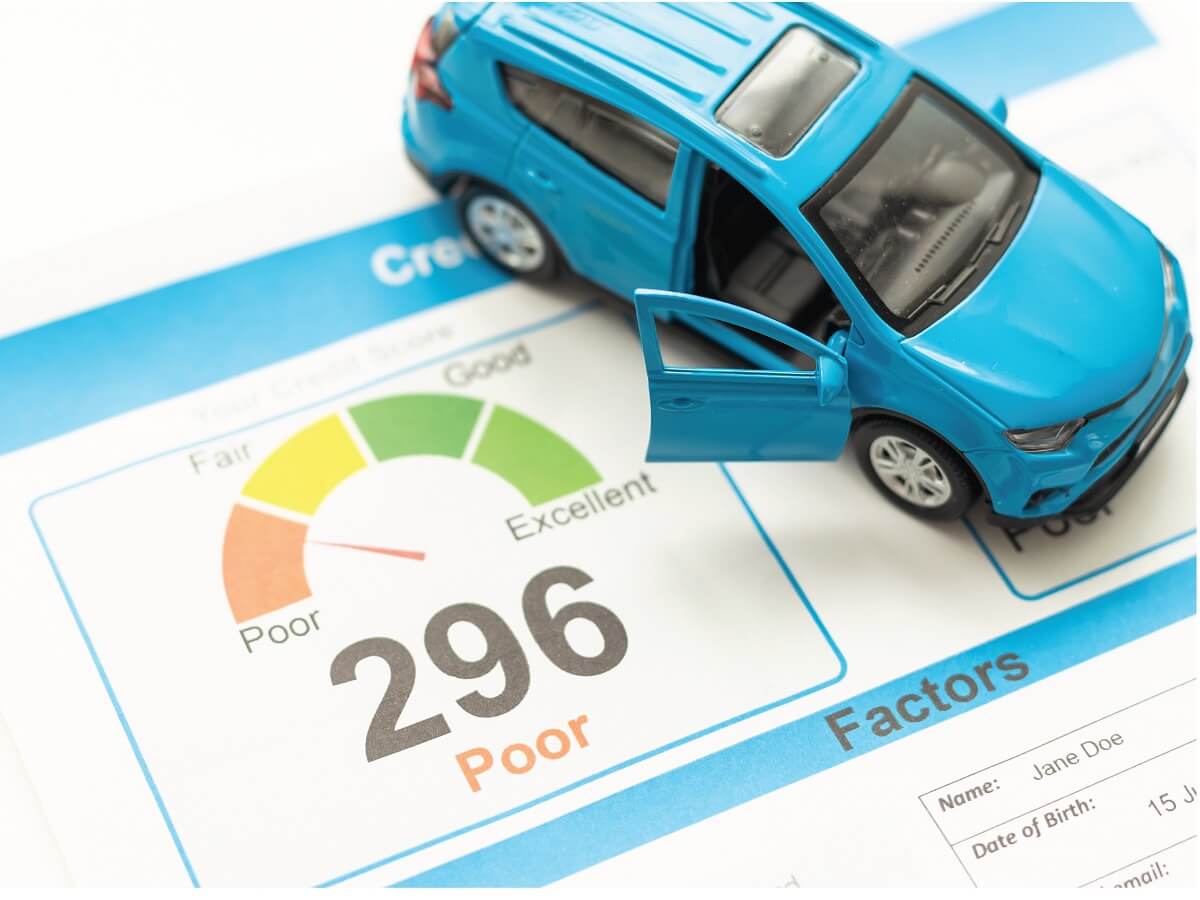

3) Can I get a car loan if I have a low credit score?

While having a good credit score increases your chances of getting a car loan approved, there are lenders who offer car loans to individuals with lower credit scores as well.