Customer First

We exist and prosper only because of our customers. We always respond to the changing needs and expectations of our customers speedily, courteously and effectively.

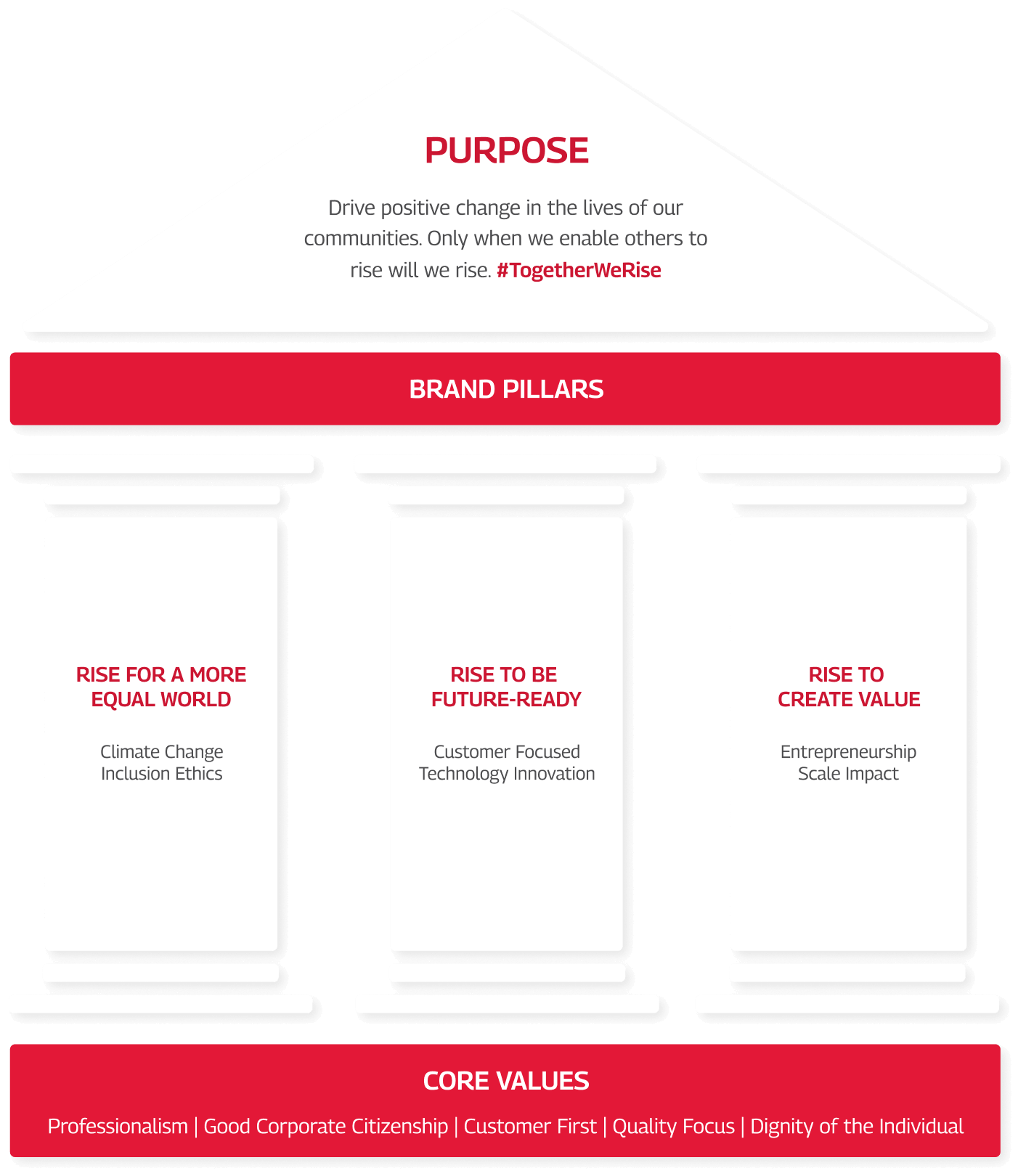

Mahindra Finance is India’s leading financial services provider committed to the needs of underserved customers in rural and semi-urban markets. We are on a journey to transform lives and uplift communities through financial growth. Our assets under management exceed Rs. 100,000 crores and our extensive network of over 1386+ offices nationwide serves our growing base of 10 million customers. With a strong local presence across the pulse of India, we pride ourselves on being able to anticipate market needs and offer unique solutions.

Our comprehensive range of financial products include Vehicle Loans, SME Finance, Personal Loans, Insurance Broking, Housing Finance, Fixed Deposits and Mutual Fund schemes. As the sole non-banking Indian financial company to be listed on the Dow Jones Sustainability Index for Emerging Markets, we are invested in sustainable growth and support our customers by opening up opportunities and simplifying finance.

At Mahindra Finance, we're passionate about pushing the boundaries to create innovative and beneficial financial solutions that truly transform the lives of our customers. Our core values prioritise both present growth and future impact. We strive for excellence in customer service, maintain the highest standards of integrity and transparency, and uphold ethical practices to provide exceptional service and exceed our customers' expectations.

We exist and prosper only because of our customers. We always respond to the changing needs and expectations of our customers speedily, courteously and effectively.

We make quality a driving value in our work, in our products and in our interactions with customers, employees and stakeholders. We believe in the theory of ‘Right the First Time ’.

We have always sought the best people for the job and given them the freedom and opportunity to grow. We support innovation, well-reasoned risk-taking and demand performance.

As in the past, we will continue to seek long-term success, which is in alignment with our country’s needs. We will do this without compromising ethical business standards.

We value individual dignity, uphold the right to express disagreement and respect the time and efforts of others. Through our actions, we encourage fairness, trust and transparency.

We push the boundaries to create innovation and beneficial products to transform the lives of our customers.

It isn't a matter of chance that we are one of India's leading non-banking finance companies. Our clear vision and determined efforts have helped us develop a set of key competencies that set us apart and propel us ahead with a diverse product portfolio.

Diverse people, perspectives and ideas have helped Mahindra Finance build a strong, dedicated and connected workforce. It is our constant endeavour to develop skill sets at grass-root levels and our 24,000+ local employees are empowered to better serve customers and clients with their local knowledge

Having been in the industry for over three decades, we have acquired a deep understanding of rural and semi-urban markets. This has enabled us to offer finance based on future repayment potential rather than just the current status of our customers. Leveraging our unique expertise, capabilities, and visions, we aim to create new opportunities for our customers.

Our business model is centred around the idea that our customers' success translates to our success. Mahindra Finance's strong brand, diverse range of financial services, loyal customer base, and innovative revenue streams, allow us to generate substantial returns for our customers and we promote an entrepreneurial culture that encourages smart risk-taking and learning.

Our strength lies in our growing base of 9 million satisfied customers, a testament to our unwavering commitment to improve lives across India. We are fostering progress and growth by bringing together people, ideas, and capital.

Mahindra Finance's association with Mahindra Group and dealers nationwide provides a competitive advantage to collaborate across boundaries. Our strong parentage allows us to leverage resources, expertise, and networks for expansion and innovation to create value for customers and stakeholders.

We treat our customers like family, and our priority is offering them value-for-money financial solutions. Our employees are dedicated to helping customers make informed financial decisions, from improving credit scores to understanding loan structures. We like to keep processes simple with fast disbursements, minimal documentation and flexibility.

Mahindra Finance is present in all Indian states and 85% of its districts, with over 1386+ offices that serve customers in more than 3,80,000 villages - that's one in every two villages in the country. Our extensive network is our unique strength, ensuring that customers are never too far from us.