Dreaming of owning a car? Whether it's for convenience or luxury, getting a car loan can turn that dream into reality. But what if you have a bad or low credit score? Don't worry; there are still options available for you.

In this guide, we'll walk you through the process of obtaining bad credit car loans and provide practical tips to improve your chances of approval.

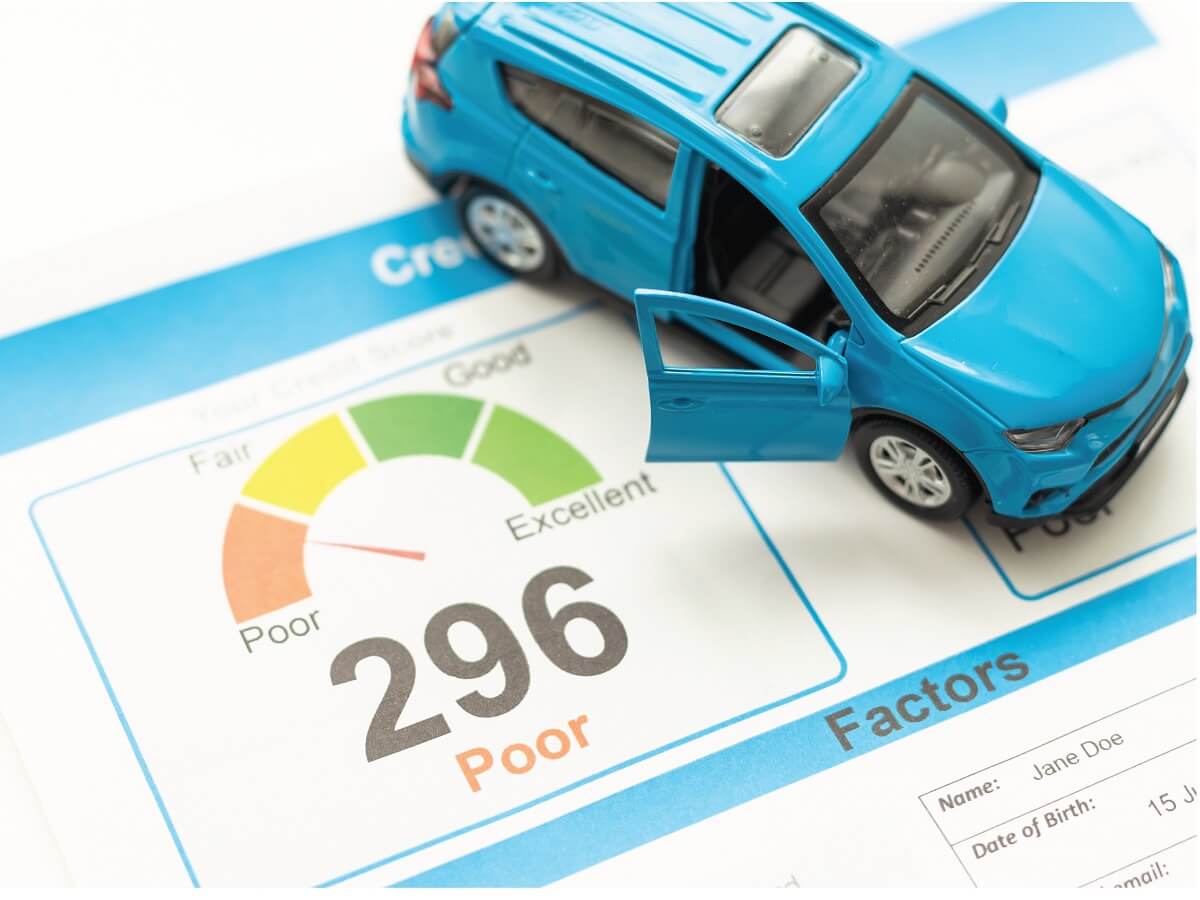

Understanding Credit Scores

First, let us quickly understand how credit scores work.

When it comes to car loans, even with bad credit scores, there are still chances of getting approved and obtaining bad credit car finance. A credit score of 750 or above is considered good, while a score below 650 is considered bad.

To improve your credit score for car loan:

- Make timely payments: Pay your loan EMIs and credit card bills on or before the due date.

- Balance secured and unsecured loans: Maintain a balance between secured loans (e.g., car loans) and unsecured loans (e.g., personal loans). A healthy mix demonstrates responsible borrowing habits.

- Avoid premature loan closure: While partial prepayments are allowed, closing a loan prematurely can negatively impact your credit score.

- Limit loan applications: Multiple loan applications can lead to rejections, which in turn affects your credit score.

Vehicle loan eligibility criteria

Before diving into how to apply for bad credit car loans, it's important to understand the vehicle loan eligibility criteria set by banks and lenders, including NBFCs. Generally, these criteria include:

- Age: The applicant must be between 21 and 65 years old.

- Minimum income: You should have a minimum annual income of ₹2 lakh.

- Work experience: Salaried individuals should have at least 2 years of work experience, while self-employed applicants require a minimum of 1 year in the same field.

Documents required for car loan application

To apply for a car loan, you need to submit certain documents along with the application form:

- Age proof: Submit a valid document such as your PAN Card, Passport, Voter's ID, or Driving Licence.

- Identity proof: Provide identification documents like your Aadhaar Card, PAN Card, Passport, or Driving Licence.

- Address proof: Adhaar card or utility bills such as electricity, telephone, or water bills can be submitted.

- Income proof: Salaried individuals need to submit their latest salary slip and bank statement, while self-employed individuals should provide their ITR, Form 16, or other income proof documents.

How to apply for a car loan?

You can apply for bad credit car loans either through the online method or the offline method.

Fill out an online car loan application on the bank or lender's website for the online method. Attach the necessary documents, such as identity, address, age, and income proof. The online method involves minimal paperwork compared to the offline method. You can also use a car loan EMI calculator to estimate your monthly payments.

If you opt for the offline method, you will need to submit your documents in person at the lender's office or bank's branch.

Tips to get bad credit car loans

Now let's explore practical tips to increase your chances of securing bad credit car finance:

- Check your vehicle loan eligibility: Before applying for a car loan, check your vehicle loan eligibilitycriteria. Understanding the eligibility requirements will help you find the right lenders and loan options.

- Avoid multiple loan applications: Cleaning up your credit and avoiding additional credit obligations will improve your chances of approval. Banks look for red flags such as late payments, outstanding debts, tax liens, and bankruptcy when processing loan applications.

- Compare vehicle loan interest rates: Research and compare car loan offers online to find the best vehicle loan interest rates available. Applicants with good credit score to buy a car generally receive better vehicle loan interest rate than those with bad credit scores.

Conclusion

Securing a car loan with bad or low credit scores is challenging but not impossible. By following these steps and making informed decisions about your finances, you can increase your chances of getting bad credit car loans. If you are looking for a hassle-free car loan, look no further than Mahindra Finance. We offer car loans with flexible repayment options, catering to individuals with bad or low credit scores. Take the first step towards owning your dream car by exploring Mahindra Finance's car loan offerings today.

FAQs

1) How long does it take to get a good credit score to buy a car?

Having a good credit score to buy a car takes time and consistent financial habits. Making timely payments, reducing debt, and maintaining a healthy credit mix can help you can gradually improve your credit score over a period.

2) What is the minimum credit score for car loan?

The minimum credit score for car loan may vary depending on the lender and their eligibility criteria.

3) Can I get a car loan without CIBIL score?

While most lenders consider CIBIL scores when assessing loan applications, some banks and NBFCs offer car loan without CIBIL scores. They take other factors such as income proof and employment history into account when considering car loan without CIBIL.

4) Can I get a low CIBIL car loan?

Yes, it's possible to get a low CIBIL car loan. While traditional banks may be hesitant to lend to individuals with low credit scores, there are other lenders, such as NBFCs, that specialise in providing loans to those with poor credit.