For many middle-class Indians, buying a new car is a major milestone in life. A car can make life so much easier in terms of daily commute, going on a fun road trip with friends and family, etc. Thanks to the easy availability of car loans, today, buying a new car has become easier than ever before.

While buying a car or taking a car loan, people may research the best car model and the best car loan lender. However, they fail to realise a critical factor relating to car loans, i.e., car loan income tax benefit. If you avail of a car loan to purchase your dream car, you can avail tax benefits.

Yes, you heard it right! Like most loans in India, like home loans or education loans, your car loan is also subject to tax deductions. As a smart and prudent investor, you must take advantage of these deductions and enjoy valuable savings. However, tax benefits on car loans are subject to certain terms and conditions.

In this guide, we explore these terms and conditions. And, who and how you can claim the car loan tax exemption?

Who can claim tax benefits on car loans?

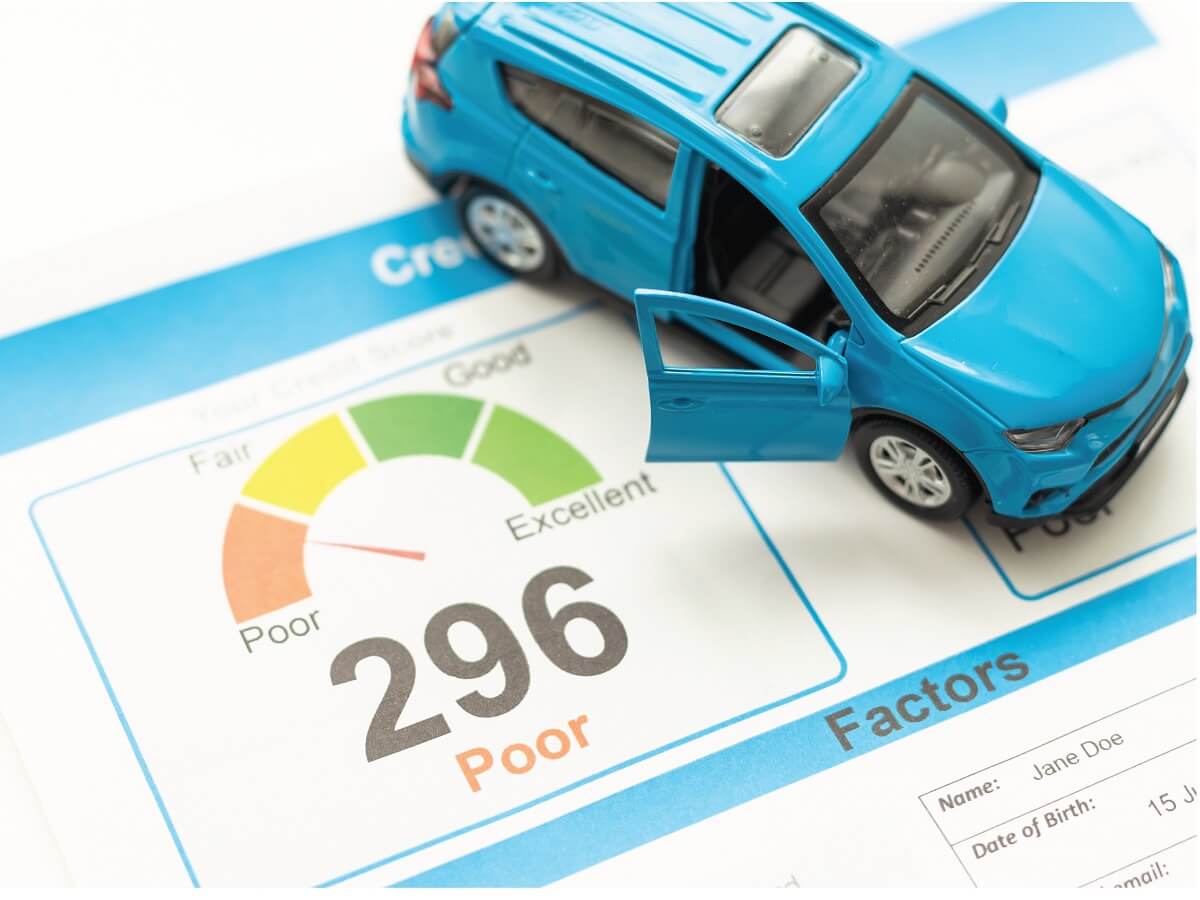

As per the tax laws defined under the India Income Tax Act of 1961, a car is considered a luxury product. Hence, if you purchase a car for personal use, you cannot claim a car loan income tax benefit. This means the interest paid on the car loan cannot be treated as an expense, and therefore, car loan tax benefits for salaried employees are not available.

On the other hand, if you are a self-employed individual or a business owner, you can apply for an affordable car loan for business purposes and show the EMI paid as a business expense to enjoy tax benefits on it. You can use the car loan EMI calculator to compute the EMI applicable on the loan you want to borrow and then make an informed borrowing decision accordingly, as this will have a direct impact on the tax benefits you get.

So, if you are a business owner or self-employed and are using the car for your business purpose, you can claim tax benefit on the car loan interest payment and reduce your overall annual tax liability.

Conditions for claiming tax benefits on car loan

Let us understand the different conditions under which you can claim car loan tax benefits with an example.

Let’s say, Mr. Girish Sharma is a 40-year-old businessperson based in Gurgaon running a small trading company.

Now, Mr. Sharma purchases a new car for his business needs, and avails a car loan of Rs. 15 Lakh at an interest rate of 12% for one year. His monthly EMI would be Rs. 1,33,273, of which the interest component of the EMI will be Rs. 15,000

In this case, Mr Sharma can claim tax benefits on only the interest payment of the car loan, i.e., Rs. 15,000.

In another situation, Mr. Girish Sharma buys a car for both personal and business use. In this case, he can divide the car loan interest payment in the same ratio as the use of the car for personal and business purposes. Let's say he uses the car for business and personal purposes in the 60:40 ratio. Then, he can claim only 60% of the interest paid on the car loan EMI as expenses and get a tax benefit on the same.

Thus, Mr Sharma can save on this tax liability, albeit a lower amount, even when he uses the care for personal use.

Apart from the tax benefit on the interest paid for the car loan, Mr Sharma can enjoy additional tax benefits on car depreciation and save a significant amount every year. A car is a depreciating asset, meaning its value reduces every year.

So, Mr Sharma can show the depreciating value of the car as an expense and claim a tax benefit on it.

How to claim tax benefits on car loans?

To claim tax benefits on a car loan, you must first list the interest paid on the car loan as a business expense while filing your income tax returns. To support your claim, you must request the lender to issue you an interest certificate that clearly mentions the amount paid as interest charges on a car loan.

Keep this document handy to avail the tax benefits.

Tax benefit on buying an electric car

Today, with rising concerns over the pollution created by the use of cars, EVs or Electric Vehicles are a viable solution to control this problem and reduce pollution and its impact on the environment.

Also, to encourage people to use EVs, the government of India offers tax benefits on availing cars for the purchase of electric cars for salaried employees. The government offers certain incentives under a new section in the Indian Income Tax Act called Section 80EEB.

Under this section, you can avail of a tax benefit of up to Rs. 1,50,000 on the interest payment of your car loan taken for buying an EV. The tax benefit on electric vehicles is available only for individuals. So, if you are a company, a partnership firm or HUF (Hindu Undivided Family), you will not be eligible for tax savings.

Please note that this tax deduction car loan for buying an EV is only available on loans between 1 April 2019 and 31 May 2023.

Final Word

As a car owner, it is paramount that you are aware of the car loan tax benefits available to you and take advantage of it. For the best offers on car loans, you can apply for the loan with reputed lenders like Mahindra Finance, which offers the loan at the most affordable interest rates, starting from as low as 6%.

The company offers a wide range of car loan solutions to suit your needs and you can also get up to 100% financing on the showroom value of the car offered by specific manufacturers.

For more details, you can visit Mahindra Finance, and apply for the loan online with just few clicks.